Download Our Guide

Follow our outline “How To Do a 1031 Exchange Like a Pro” guideline. We follow this guideline during all of our Like Kind Exchanges.

Our founder’s instruction on reporting the Exchange is used nationwide. We have helped thousands of clients with exchanges of all values.

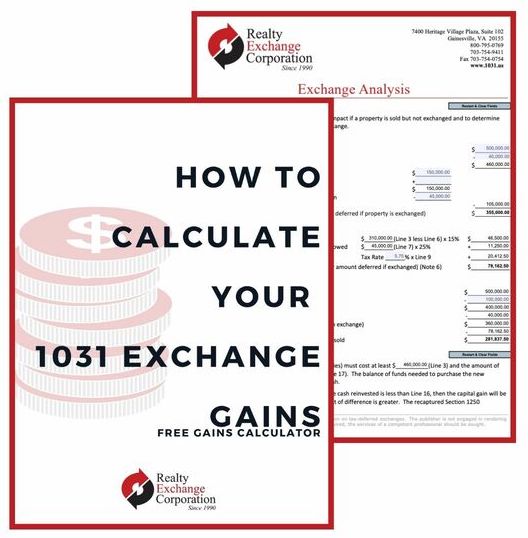

Calculate Your Gains

Realty Exchange Corporation has created this simple Capital Gain Analysis Form and Calculator to estimate the tax impact if a property is sold and not exchanged and to calculate the reinvestment requirements for a tax-free exchange. Fill out our form above and you will also receive a free capital gains calculator.

About Us

Since our founding in 1990, Realty Exchange Corporation’s sole mission is to provide qualified intermediary service to real property investors and their advisors for 1031 exchanges.

William Horan is a Certified Exchange Specialist® (CES), the qualified intermediary industry’s prestigious designation. The CES® designation requires years of experience, testing, adherence to a code of ethics and on-going continuing education.