Steps to a 1031 Exchange

This page is a summary of a standard 1031 exchange of one investment property for one investment property. If your exchange does not fit into this exact process and you have questions about how that will impact your exchange, do not hesitate to give us a call: (703) 754-9411

Step 1: Contract and Exchange Documents

Once you have a contract to sell the property you wish to exchange, send it to us with your settlement agent’s contact information. We will create our Exchange Agreement and Assignment needed to assign REC into your contract to serve as your qualified intermediary. We will send instructions to your settlement agent.

Step 2: Settlement of Relinquished Property

When your relinquished property closes, the funds will be transferred directly from closing to REC to be held in an escrow account in your name. We will advise you when we have received the funds. From this point you have 45 days to identify replacement properties and 180 days to close on the property or properties you identify.

Step 3: 45-Day ID Period

During your 45-day ID period, locate properties that you might want to reinvest in. Be sure to identify properties that you are confident that you can purchase. There are limits to how many properties you can identify, the most commonly followed limit is that you can identify three properties. Click the adjacent button for more details on identifying properties.

Step 4: Contract on Replacement Property

When you have a contract to purchase a replacement property, send us a copy of the contract and the settlement agent’s contact info so we can create the addendum assigning REC in to the contract to purchase the property on your behalf. We will send instructions to the settlement agent to assign us in to the contract.

Step 5: Settlement on Replacement Property

We will send your exchange funds directly to settlement, and you will take ownership of your replacement property. After closing we will send you a final statement summarizing your exchange.

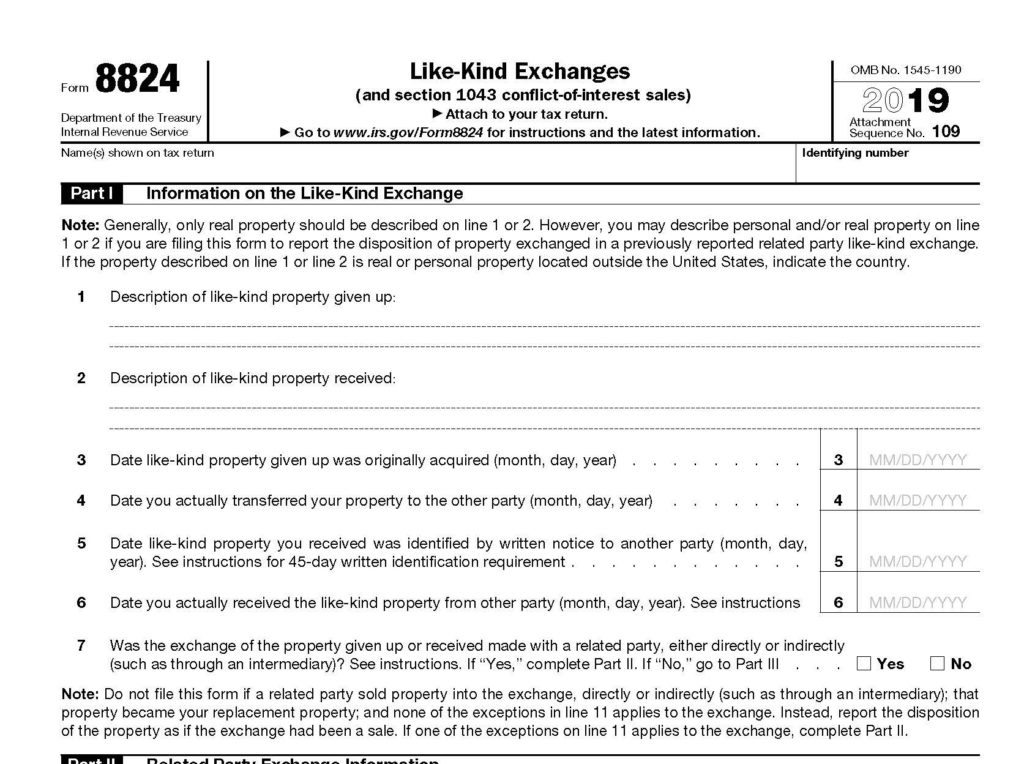

Step 6: Reporting the exchange to the IRS

The last step happens when you file your taxes for the year the exchange occurred. You must report the exchange to the IRS on Form 8824. With your final statement, we will send our workbook explaining how to fill out your Form 8824 properly.

Click the image to be taken to a fillable PDF of Form 8824 on www.irs.gov